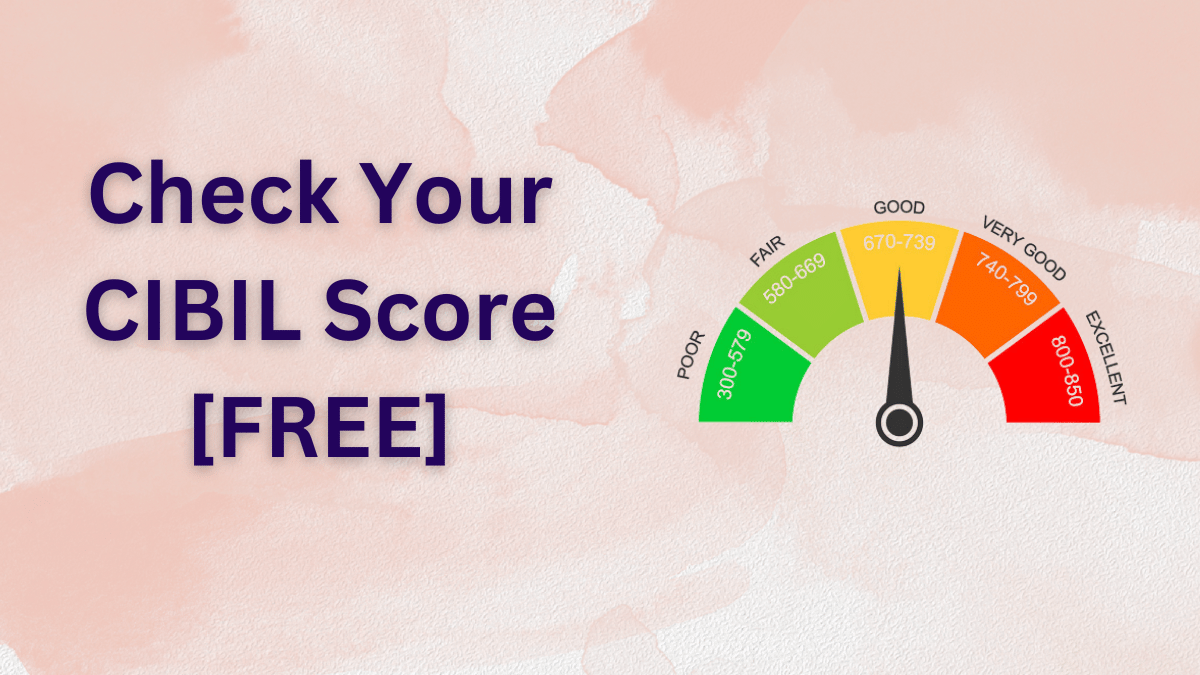

A good CIBIL score is outlined as a score at or higher than that you ought to be able to get a loan simply at very cheap interest rates, subject to your eligibility and alternative documents check. Typically, Indian banks take into account a score of 700 and higher than as an honest CIBIL Score. Further, banks might invite a better score for unsecured loans as compared to secured loans like home loans. You’ll check your free CIBIL score Online Site List 2024 anytime on our web site

Good CIBIL Rating in India

| Loan Type | Good CIBIL Score |

| Home Loan | Above 650 |

| Personal Loan | Above 700 |

| Loan against Property | Above 650 |

| Business Loan | Above 700 |

| Car Loan | Above 700 |

| Gold Loan | Not required |

How is CIBIL Score calculated?

CIBIL score is calculated by varied credit bureaus victimization their own proprietary formula, however, the most components of score composition revolve around loan and MasterCard compensation behavior of a person. CIBIL score could be a range between 300 and 900. Higher the score, the higher the credit account of the receiver. The nearer you’re to 900, the additional possible it’s to induce a loan approved from a bank. Expertise says that a Credit Score of 750 and on top of is thought-about as an honest enough score by banks at the time of doing a credit appraisal of your application.

A CIBIL Blog mentions that four factors pertaining related to the credit behavior of a borrower are considered while calculating the CIBIL score. These factors are:

- Credit History: You’re past credit record or your credit history is of the very best importance within the score calculation. Your past credit track record features a weightage of around half-hour within the formula for hard your CIBIL score. All banks and NBFCs share the payment track record of every individual recipient with CIBIL on a daily basis. The agency compiles knowledge and uses an equivalent for score calculation. This info captured could be a month-on-month record of the newest three years of your payments towards your bills and EMIs capturing timely payments, delayed payments, settled and written-off quantity.

Tip – Always make timely payments on all loan dues. Never leave any loan unsettled even if there has been a default or delay in payments.

- Credit Utilization: Your current outstanding loan obligations divided by your available limit is used to calculate the level of your credit utilization. When you have a high credit utilization ratio highly impact your CIBIL score. The credit utilization ratio has a weightage of 25% in your CIBIL score calculation.

Tip – Restrict your credit card over-dues to up to 50% of your credit card limit. You should avoid short term loans and multiple numbers.

- Credit Mix: Your loan portfolio composition in terms of the proportion of secured and unsecured loans also has a bearing on your score. A higher proportion of unsecured loans in your total loan portfolio has a negative bearing on your credit score. Credit Mix is estimated to have a weightage of 25% in your score calculation.

Tip – Restrict the proportion of unsecured loans in total loans portfolio to less than 30%. Avoid holding more than 2-3 credit cards.

- Other Factors: additionally to the on top of 3 factors, the number of credit applications you have got submitted within the previous few months even has an effect on your score. If your CIBIL report shows multiple loan applications that are rejected within the recent past, it gets mirrored in a very lower credit score. Banks are disinclined to lend to borrowers, another bank agency is rejected by alternative banks. These alternative factors are calculable to possess a weightage of up to 20% in your CIBIL score calculation. Hence, it’s very vital to use to pick banks when a radical analysis and comparison of loan schemes of all banks in India.

Why is maintaining CIBIL scores important?

A CIBIL score is sort of a fingerprint. It clearly offers an image of somebody’s monetary health and the way responsibly he uses his cash. The general public isn’t even tuned in to the credit evaluation method until they apply for a loan! And so it dawns on to the tiny steps that would are taken in way of life to possess an honest CIBIL rating. However, that may be too late because the person’s application would have already been rejected and he would be left on to a loan path to reconstruction or up his CIBIL score.

Here are some of the ways in which your CIBIL report can affect your finances as well:

- CIBIL rating influences the ability to avail loan: With a coffee CIBIL rating, your application could also be rejected. The loaner would possibly contemplate you speculative and so not willing to lend. The banks and large finance firm’s square measure choosier as they provide a coffee rate of interest on the loan. The money implications of not having the ability to urge a loan at cheap rates to fulfill your home shopping for, personal or business needs square measure well understood.

- Good CIBIL Score can help you save your money: Smaller NBFCs and finance firms have additional relaxed loan eligibility parameters. However, they charge the next rate of interest to complete the upper risk they attack sure client profiles. So, even though you get a loan, you would possibly pay the next rate of interest for constant quantity borrowed.

All banks, NBFCs, and finance firms can pull out your credit report back to get a transparent image of your credit history. The CIBIL score is a sign of your trustiness and so responsibleness and can conjointly verify the speed of interest you may find yourself paying on your loan

- Good CIBIL report gets you better deals: High CIBIL report would give many benefits like:

- Higher-end credit cards with better reward points

- Cashback offers

- Discounts like surcharge waiver for fuel

- Better flight reward points

- Airport lounge entry card

- Some freebies, etc.

These edges wouldn’t be extended to somebody with a coffee CIBIL score. Individuals can higher credit scores get regular offers from banks and MasterCard firms to upgrade to high-value credit cards with multiple rewards and edges.

Bearing these points in mind will certainly assist you to attain the specified credit goal. a decent CIBIL score not solely improves your likelihood to induce straightforward approval of your MasterCard or loan, however, it additionally helps you get very cheap interest rates, higher tenure or best loan eligibility!

So, the best step taken towards a healthy CIBIL report is helpful in additional ways in which than one.

How to Improve the CIBIL score?

Your CIBIL Score is predicated on your credit behavior and past credit reimbursement track record. Banks submit your loan details to CIBIL on a daily basis that over-time gets documented in your credit report and is employed to calculate your score. A number of the vital factors that are utilized in your CIBIL Score calculation together with tips to take care of an honest score have been enclosed within the table below:

Tips to Improve your CIBIL Score:

- Keep your CIBIL Report free of errors: There are cases when you have been a good borrower and have repaid your loans on time. However, due to system errors, your score is lower than what it should be.

For example, Mr. Jay had paid off his loan in full and had closed down the loan account as well. But due to some technical or administrative error, the loan account was still showing active in his credit report. Then you informed the loan agency for wrong reporting. By making corrections, he was able to improve his score.

Tip: Always check CIBIL Score on a regular basis, especially after closing a loan or a card.

- Do not delay or missed any payment: The repayment schedule is important to factor for calculating the CIBIL score. The track record of payment made towards loan or credit card make up to one-third of the score. Any kind of late payment will directly affect your CIBIL rating

Tip: If you start paying off your bills on time, you can immediately see a positive impact on your score.

- Do not revolve your credit card balance: Being a balance payer of credit cards has a great impact on your score. It means, whenever a credit card bill is due, make the full payment instead of the minimum amount. This definitely improves your credibility with the lender.

Tip: Make small purchases on your credit card and pay them on time.

- Limit the utilization of your credit limit: The easiest way to improve your CIBIL score is to avoid utilization of your full credit card limit. The trick is to limit the utilization of your monthly credit card limit to 50% of the total.

For example, If you have a credit limit of Rs.50,000 a month then you should not exceed half of your credit limit.

Utilisation of your credit limit more than 50% generally signifies that you might have financial issues. This signifies that you may not be in a position to keep aside some amount to pay off your debt on time.

Tip: Get a credit card of a higher limit and then spend less than 30% of the limit to improve your score.

- Do not go for a credit card or loan settlement: A credit card or loan settlement happens when you are unable to pay your EMI on time. The borrower then offers to close the entire debt for a mutually agreeable amount. This settlement amount is usually much lower than the total amount that needs to be repaid. However, once your credit card is “settled” for a lesser amount, you would get a very bad spot on your CIBIL report.

Tip: Alway’s a settlement (Closed) card or loan completely so as to avoid this bad spot!

- Avoiding multiple credit cards or loan applications in a short period of time: If your inquiries attempted multiple times or apply for a loan in a short time this also sign a decreasing CIBIL score. Lenders may get edgy about your credit profile, feel that you are cash crunched and may be hesitant to lend to you if other banks have rejected your loan application recently.

Tip: Space out your application of loans so that the lender is not scared off!

- Opt for secured loans or credit cards: Even if you have a low CIBIL score, you could easily avail a secured loan like a Gold Loan. Your CIBIL scores do not declare to avail of the loan against collateral.

Tip: Ensure you repay your secured loan or gold loan on time to improve your score.

Usually, it takes about 180 to 365 days to improve your CIBIL score, if you do the right steps.

Factors that Impact your CIBIL Score

| Parameters | Weightage (Approx) | Factors that impact your score |

| Past repayment track-record | 30% | Timely Loan payments, loan defaults, over-dues, and loan settled |

| Portfolio mix | 25% | % share of secured and unsecured loans |

| Credit utilization | 25% | Credit limit utilization, number of loans |

| Other factors | 20% | Number of loans, number of applications, |

Why do I have a poor CIBIL Score?

It is extraordinarily vital to contemplate any early warning signs and take corrective actions to boost your score. Typically, poor CIBIL rating reflects the past credit reimbursement log of the recipient. However, generally, it’s going to be result of reportage errors by banks.

Below could be a list of parameters that may adversely impact your CIBIL score:

Low CIBIL score thanks to wrong reportage by banks

Though CIBIL Score is got to replicate the credit behavior of a recipient, generally wrong reportage by banks could translate into a coffee CIBIL Score. A number of the common errors by banks that may impact your score are:

- Wrong credit info provided by banks

- Record not updated even after the customer has paid

- Lenders classifying a/c as “settled with loss” while actually the dues were disputed

- Lenders showing amount as “overdue” even when the demand is contested by the customer

Low score due to past behavior of the borrower

Credit behavior and repayment track record of the borrower are some of the factors that result in a low CIBIL score. Some of the common credit behavior factors that result in a low CIBIL score check of borrowers are:

- Write-offs reported, particularly in last 2-3 years on secured loans, unsecured loans, and credit cards

- Outstanding credit card dues

- Delay in payment of EMI’s on a home loan, loan against property, personal loan, consumer loan, gold loan or any other loan

- Too many loans already availed

- High credit availed on credit cards

- Too many loan applications made in the recent past

- A higher proportion of unsecured loans in total loans outstanding

Understanding CIBIL Score Details

If you download your free CIBIL report, you will notice that the report evaluates the following factors for calculating your credit score.

| Credit Parameter | How it impacts your score |

| Past Payment Track Record | Repayment track record of all your past debts Consistent track record of meeting payments on time drives a higher score Delayed payments lead to a lower score More recent the delays, more the negative impact |

| Write-Offs, Settlements Past Defaults | Write-offs recorded by financer on past debts pull down your score Recent write-offs are viewed more negatively than the older ones Multiple write-offs lead to a significantly lower score Defaults or delays in repaying secured |

| Secured Loans Vs. Credit Cards and Unsecured Loans | Greater reliance on unsecured loans (credit cards, personal loans), as opposed to secured loans, is viewed negatively Fewer of such accounts with regular payment history support a higher score High balances (as a proportion of total limit) on credit cards drive down the score |

| Loans as a Proportion of Income | High loan balances (as a proportion of income) tend to pull down score Low balances indicate healthy credit usage habit and lead to a higher score |

| Loan Enquiries | Too many loan inquiries made for availing loans in the recent past reflect a “credit hungry” behavior and affect the score negatively |

Factors that do not impact your CIBIL Score

Many times, we tend to get distressed that a delay in any of our obligatory payments like tax or utility bill payments could get reportable as a CIBIL default and impact our score adversely. However, several of those events don’t seem to be reportable to Credit Bureaus and thus, don’t impact your CIBIL Score. Few factors that don’t impact your Score are:

- Payment track record of utility bill payments including mobile and electricity

- Prepayment of loans or transferring your loan to another bank

- Payment track record of rent payments

- Cheque Bounces in your bank account

- Your Spouse’s CIBIL Score

- Regularly perform the CIBIL score check.

- Any delay or defaults in tax payments

- Delay or default in paying to your suppliers or trade partners

While you’ll breathe straightforward that the on top of events doesn’t seem to be aiming to have an effect on your credit score, one word of caution: several of those factors should still be evaluated by the bank whereas taking a call to lend. So, indirectly they will impact your eligibility to induce a loan. Our recommendation is to follow a healthy and disciplined observe towards paying all of your dues in time as:

- Many banks and NBFCs check your bank statements for cheque bounce data or your utility bills payment track-record to judge your credit-worthiness. This can be very true within the case of unsecured business loans or SME loans.

- Similarly, the banks may check your spouse’s CIBIL score to determine the credit goodness and calculate the eligibility of the family as a unit or in cases wherever you’ve got filed a joint an application or square measure business partners.

- In the recent past, there is increasing agreement on as well as utility bill payments record as a section of CIBIL score calculations. This can be a well-liked follow in several developed countries and there’s a chance of it obtaining enforced in India furthermore.

Comparison of CIBIL, Experian, Equifax and TransUnion Credit Reports

| EQUIFAX | CIBIL | EXPERIAN | HIGH MARK | |

| Years in India | Received license in 2010 | Established in 2000 | Received license in 2010 | Received license in 2010 |

| Range | 300-850 | 300-900 | 300-900 | 300-900 |

| Free Credit Report | Annual credit report (without credit score) | Annual credit report (without a score) | Annual credit report (without a score) | NA |

| Paid Credit Score | Rs 400 | Rs 550 for one-time Credit Score | Scores and reports can be bought online for Rs. 399 | Rs 399 for a report with a score |

How to check credit score in India?

CIBIL score is provided by CIBIL beside careful Credit data Report (CIR) on payment of Rs. 550 to CIBIL. From first Gregorian calendar month, 2017 you’ll be able to raise CIBIL or any of the opposite bureaus, Experian, Equifax or Highmark to issue a replica of free credit report beside score while not paying any charges. However, to simulate your CIBIL score supported your past credit history, you’ll be able to conjointly like better to use MyLoanCare. Free CIBIL Score Calculator. You’ll be able to check CIBIL score free by exploitation PAN card.

How to get an online CIBIL Score?

In the online world, checking your CIBIL report is simply clicks away. Varied on-line finance market places like MyLoanCare will calculate your calculable score fairly accurately. All you’ve got to try and do is visit their web site, fill your details within the ‘Free CIBIL score calculator’ and find your calculable score.

Besides this, you’ll forever get your credit score at CIBIL’s official web site (www.cibil.com) by following these easy steps:

- Click on the ‘Get Your Credit Score’.

- Choose a subscription product.

- Fill within the details regarding your PAN and identity proof etc.

- Click on ‘Proceed to Payment’.

- Once you’re redirected to the payment entranceway, create the payment.

- Your CIBIL report and score are sent to your email ID at intervals 24 hours or to your shipping address if you choose for a tough copy.

How do I check the CIBIL Score by PAN card?

PAN or Permanent Account range may be a common document that offers every individual a novel identity, permitting them to associate the PAN range with all their monetary transactions. Once a PAN is employed for viewing your CIBIL, it makes it easier and faster to find your details and transfer your CIBIL report.

Free CIBIL Score: you wish to follow these straightforward steps to visualize your CIBIL Score for free of charge by exploitation your PAN card:

- Visit the official web site of CIBIL

- Fill in your PAN card and different details

- Click on ‘Submit’

You can value more highly to get a tough copy or a soft copy of your credit score report, following that your CIBIL report is delivered via post or e-mail inside 24 hours

Paid CIBIL Report: just in case you’ve downloaded a free CIBIL report earlier throughout the year, you may not be eligible to induce a second free CIBIL report within the same year. However, you’ll still purchase the CIBIL report with the subsequent steps:

- Visit the official web site of CIBIL (www.cibil.com).

- Click on the ‘Get Your Credit Score’.

- After selecting your subscription product, and filling within the details, click on ‘Proceed to Payment’.

- Once you’re redirected to the payment entryway, build the payment.

- Your CIBIL report and score are going to be sent to your email ID among 24 hours.

Free CIBIL Score check website Lists

Below the list, you see the Free online check CIBIL Score and generated monthly CIBIL reports.

Why should you know you’re CIBIL Score?

Ensure Accuracy: Your CIBIL report contains info of your credit history and payment data of your loans. By reading your CIBIL report annually you’ll be able to make sure that the data mirrored within the report is correct. If you discover any corrections within the report, then you’ll be able to address the matter on the dispute resolution forum of CIBIL.

Keep an eye fixed on your loan accounts: A CIBIL report is careful to outline all of your loan accounts and credit cards. CIBIL report helps you in observance of your loans and credit cards. If your CIBIL report shows any loan that you just haven’t availed, then you’ll be able to flag the matter on the credit dispute resolution board for resolution.

Maintaining your credit health: CIBIL score reflects your credit position. It tells you concerning the debt closely-held and also the outstanding quantity of your loan accounts and credit cards. If your CIBIL report shows a coffee CIBIL score, then you’ll be able to take active measures to enhance your credit health.

In summary, the CIBIL report permits you to conduct a whole monetary check-up a bit like a health medical examination to confirm that there’s no monetary stress or adverse factors impacting your credit health.

Required CIBIL Score for a Personal Loan

A high CIBIL score, alongside a clean CIBIL report on all key factors that area unit used for credit score calculation is one in all the foremost necessary eligibility criteria for obtaining a private loan from leading banks like HDFC Bank, SBI, Axis Bank, ICICI, Citibank, etc. A credit score of 650 and on top of is needed to induce a private loan.

How to remove my name from CIBIL Defaulters list?

CIBIL doesn’t publish any CIBIL Defaulters list. If you’ve got defaulted in your loan payments, a similar get mirrored as a lower CIBIL score in your report. An occasional score would mean that you just are less seemingly to induce a loan from banks and NBFCs in the future, as and once you want it.

Once, any negative credit event like delayed payment or payment default is marked in your CIBIL report, it’s going to hamper your probabilities of obtaining a loan for years to come back. Reconstruction credit score may be a long drawn method. Hence, the bar is often higher and easier to be able to maintain a healthy CIBIL score. You’ll bring home the bacon and maintain a decent score by being prompt

FAQs About the CIBIL Score

How can I increase my CIBIL score?

Follow these steps to increase your CIBIL score:

1.Make sure to pay your monthly dues on time.

2.Completely pay off the loans for which you have made a settlement.

3.Maintain a good credit mix of secured and unsecured loans.

Does EMI affect the CIBIL score?

Yes, paying regularly EMI on time increases your credit score, another side the late payment of EMI brings your CIBIL score down.

Does ECS bounce affect the CIBIL score?

Yes, any return of payment is attracted to some additional charges depending upon the bank holder’s account. However, it does not affect your CIBIL score. Any late payment or missed payment direct affect your credit score.

Does loan rejection affect the CIBIL score?

Yes, loan rejection does bring your CIBIL score down

How to improve my CIBIL score?

You can improve your CIBIL score by:

1. Making timely payments of your dues.

2. Paying off credit cards with a comparatively lower outstanding balance.

3. Having a balanced mix of secured and unsecured credit.